In early October 2023, more than two thousand militants from the Palestinian group Hamas broke through the border barrier between Israel and the Gaza Strip, carrying out pogroms and robbery attacks on border cities and towns. The operation was called Operation Al-Aqsa Flood, and it resulted in the killing of about 1,200 Israelis. Another 242 civilians were taken hostage. These events marked the beginning of a new escalation in the Middle East, which by the end of the year attracted the primary attention of the world community.

While many were speculating about how Hamas militants managed to sneak through the most secure border in the world, what primary goals they pursued, and what a new war between Israel and Palestine could lead to, unfolding events in the geopolitical arena began to demonstrate that the issue lies in much broader area. Such an escalation’s consequences could affect most world states’ economic and political interests.

In this publication, Ascolta analyses the situation in the Red Sea, where, against the background of hostilities between Israel and Palestine, a global escalation has occurred, which has serious consequences both for international logistics and for the political positions of many states in the Middle East region.

This Content Is Only For Subscribers

How is the focus shifting from Israel to Yemen?

Back in early August 2023 – several months before the events in Israel and the Gaza Strip – the U.S. Navy Central Command announced the arrival in the Red Sea of two landing ships – USS Bataan and USS Carter Hall, with more than three thousand military personnel, whose primary mission is to counter Iranian attempts to seize commercial ships. At that time, few people noticed this since the American Navy, like the navies of several other Western states, had previously been actively present in the Red Sea or the Gulf of Aden. However, after just three months, the situation changed dramatically.

On November 14, in response to Israel’s ground operation in the Gaza Strip, Yemen’s Houthis said they would consider Israeli vessels passing through the Red Sea as legitimate targets because they could be carrying military supplies. Thus, the Houthis demonstrated their support for Palestine. Already on November 19, the militants moved from words to deeds – off the coast of Yemen, the Houthis seized the cargo ship Galaxy Leader, owned by the British-Japanese company Ray Car Carriers, but the parent company Ray Shipping was registered in Tel Aviv, which became the reason for the seizure of the ship. In early December, information appeared in the media about a Houthi attack on a merchant ship flying the British flag using a UAV; a U.S. Navy ship and several merchant ships came under fire from Yemen, which the Houthis themselves later confirmed. A few days later, there followed an attack on the Norwegian ship Strinda with an anti-ship cruise missile, shelling of the Ardmore Encounter and Swan Atlantic tankers, and an attack on the Maersk Gibraltar and Clara container ships. According to the Pentagon, since the beginning of the escalation of the conflict, representatives of Ansar Allah have carried out more than 100 attacks on ships. In turn, the Houthis announced their intention to attack ships in the region every 12 hours.

In response to the Houthis’ actions, several Western states, led by the United States, announced an increased presence in the Red Sea due to the need to protect shipping through the Suez Canal. On December 17, U.S. Secretary of Defense Lloyd Austin officially announced the formation of an international coalition to conduct Operation Prosperity Guardian. In addition to the United States, the list of participants included Bahrain, Great Britain, Denmark, Spain, Italy, Canada, the Netherlands, Norway, Seychelles and France. Israel and forces representing the internationally recognised government of Yemen have also been invited to join the coalition.

In turn, the United States said 20 countries had joined the organised coalition, but eight chose to remain non-public due to high political sensitivity. Also, at the time of the publication of this article, South Korea was considering the possibility of joining the international coalition, but a final response had yet to be made. At the same time, Australia decided to refrain from sending its ships to participate in the operation, since the country’s interests are concentrated in other regions.

How many international coalition ships are present in the Red Sea?

The grouping of naval forces of the international coalition, which has gathered in the Red Sea in recent months, is called by many experts the largest in recent decades. As of early January 2024, there are already three American destroyers and a nuclear warhead in the Gulf of Aden area. Also, the nuclear-powered aircraft carrier USS Dwight D. Eisenhower recently arrived in the Bay Area with three escort ships, and another aircraft carrier is heading toward the Middle East. The air wing of an American aircraft carrier has about 100 aircraft of various types that can perform multi-role missions: air patrols, surveillance, and strikes against ground, air and sea targets.

On November 30, British Defense Secretary Grant Shapps ordered the deployment of the destroyer HMS Diamond to the Suez Canal to maintain security in the Middle East region. The destroyer HMS Diamond has joined the Kipion mission, which began in 1980 – the U.K.’s naval presence in the Middle East to ensure shipping safety.

The Italian Ministry of Defense on December 19 announced the decision to send the frigate Virginio Fasan (F 591) to the Red Sea to ensure the security of sea routes. This decision was made following a meeting between the heads of the Italian and U.S. Ministries of Defense, Guido Crosetto and Lloyd Austin.

In early December, the French naval frigate F.S. Languedoc also joined the international coalition, which on December 11 successfully repelled a Houthi missile attack on the Norwegian tanker Strinda.

At the same time, other international missions continue to be implemented in the Red Sea, in which warships from many countries participate (the Combined Maritime Force (CMF) includes 39 countries, the E.U. Operation Atalanta and others).

Who else sent ships to the Red Sea?

Back on October 21, 2023, it became known that a group of six warships of the Chinese Navy, which had recently completed joint exercises with the Omani Navy, was heading to the Gulf of Aden. The Chinese mission in the Red Sea has been operating for the past six months to protect cargo ships from pirates. Yet, amid the escalating situation in the region, it has been reinforced by the Type 052 destroyer Urumqi, the frigate Linyi and the supply ship Dongpinghu.

On January 2, the Iranian destroyer Alborz set sail for the Red Sea, sparking much speculation about possible further escalation. It is important to note that Iranian ships have been operating in the region to secure sea lanes since 2009. Still, an Iranian Navy destroyer headed to the Red Sea immediately after the U.S. Navy sank three Houthi ships that attempted to attack the container ship Maersk Hangzhou on December 31.

It is noteworthy that almost immediately after information appeared about the increased presence of the Iranian Navy in the Red Sea, the American aircraft carrier group, led by the largest and most advanced aircraft carrier, USS Gerald R. Ford, left the escalation zone and on January 5 had already passed the Strait of Gibraltar and headed to the side of the USA. Of course, these events should not be connected since the navies of the United States and Iran are absolutely incomparable. Nevertheless, many perceived such a castling as an attempt by the United States to protect its flagship aircraft carrier from possible unforeseen situations.

First results of escalation

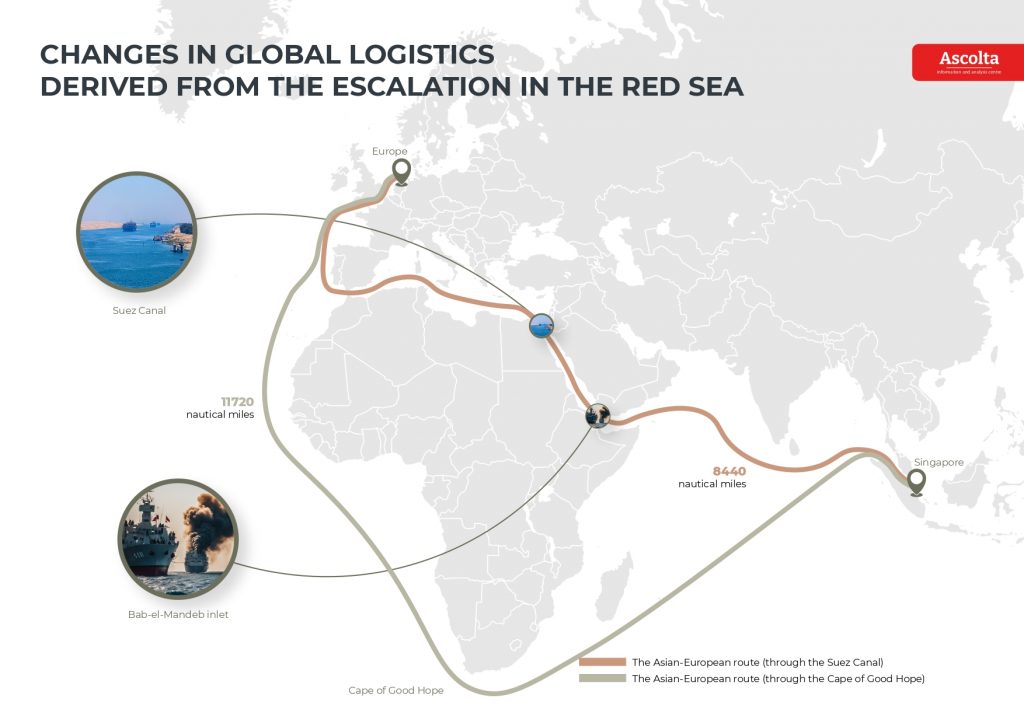

It is important to note that the Suez Canal, partially blocked due to the escalation in the Gulf of Aden, carries about 15% of world shipping and is the shortest route between the Indian Ocean and the Mediterranean Sea of the Atlantic Ocean.

After months of tension in the Red Sea, several major shipping companies, including MSC and Maersk, began to change their usual Suez Canal routes and bypass Africa (the route is 8,000 kilometres longer), adding costs and delays, already causing an increase in world prices for many goods.

At the beginning of 2024, oil and gas giant British Petroleum also joined in abandoning routes through the Red Sea, which almost immediately increased oil prices by more than 2%.

On Wednesday, January 4, the U.N. Security Council held an emergency meeting due to increased tension in the Red Sea. U.N. Assistant Secretary-General Khaled Khiari warned that military escalation would have adverse political and humanitarian consequences.

Significant background events

It is worth noting that behind the intensification of hostilities between Israel and Palestine, as well as the general escalation of the situation in the Middle East, other, no less essential events remain practically unnoticed by the world media but apparently cause serious concern among the international coalition consisting mainly of Western countries.

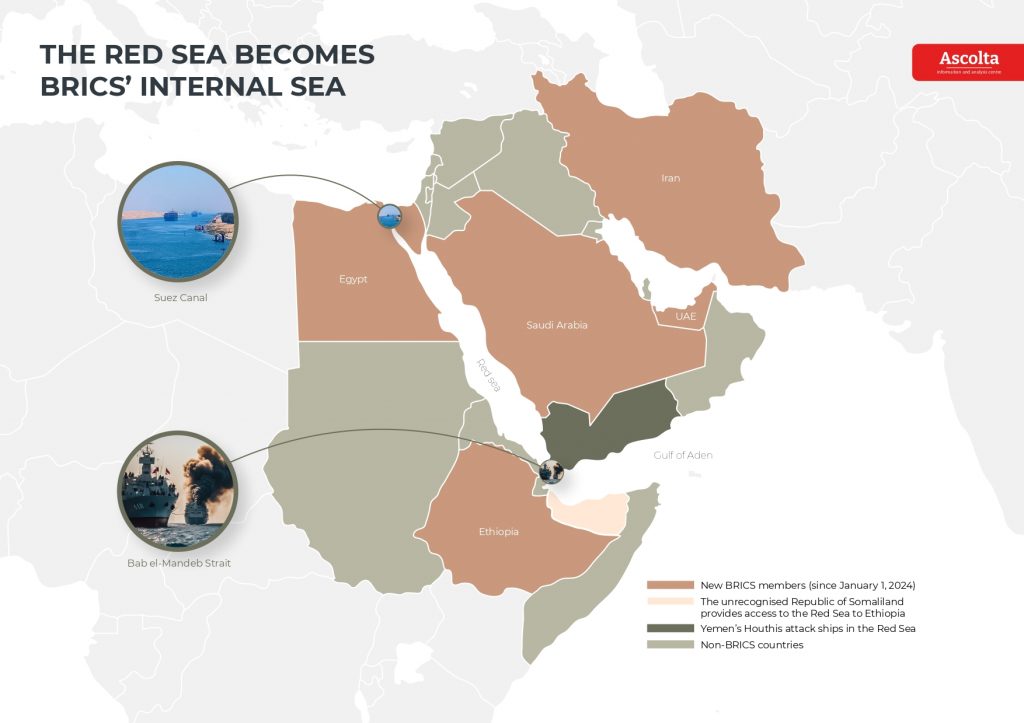

Firstly, on January 1, 2024, the largely China-oriented BRICS organization officially accepted five new members: Egypt, Iran, Saudi Arabia, the United Arab Emirates and Ethiopia. This circumstance significantly strengthens China’s position in the Global South and effectively makes the Red Sea an internal sea of BRICS. China’s increasing influence on Egyptian politics could further lead to the Suez Canal being used to regulate supply chains for individual manufacturers or countries. The refusal of several transnational corporations to use the Red Sea for transporting goods may be only the first evidence of such a strategy to regulate trade turnover artificially.

Secondly, at the beginning of 2024, an important deal occurred between Ethiopia and the unrecognised Somaliland. Prime Minister of Ethiopia Abby Ahmed and President of Somaliland (an unrecognised state) Musa Bizi Abdi signed an agreement on transferring the Berbera seaport in Somaliland to Ethiopia. According to this agreement, a base for the Ethiopian naval forces will also be located in the waters of the commercial seaport. Thus, in Africa, another state with access to the sea appeared. Moreover, the signing of a formal agreement between the government of Ethiopia and the leadership of Somaliland is a de facto recognition of the latter’s independence by Ethiopia. Interestingly, at the end of December 2023, Somalia and Somaliland (which declared their autonomy from Somalia in 1991) agreed to resume negotiations to resolve their disputes.

Ethiopia relied on neighbouring Djibouti for much of its maritime trade for many years. Despite its tiny size and the virtual absence of its resource base, Djibouti attracts the primary attention of other states precisely because of its access to the sea. Located on the Bab el-Mandeb Strait coast – at the narrowest point on the route from the Arabian Sea to the Suez Canal – Djibouti has become an ideal location for foreign military bases. This is the only state in the world with a Chinese military base outside China itself. Also, in Djibouti, the United States, Japan, France and Italy have military bases.

At the same time, there is a high probability that neighbouring Somaliland will soon host an Ethiopian military base and a renewed Russian military base (Berbera was once the site of a military base of the Soviet Union). Moreover, Russia and Somalia almost entirely lack both economic and diplomatic relations, which makes it possible for Moscow to recognise the independence of Somaliland and begin strengthening bilateral ties both in the financial and military planes. In this case, Russia can count on the support of China, which will not give up on strengthening its allied positions in the region.

Thirdly, against the background of the escalation of the situation in the Red Sea and the gradual refusal of several companies to use this route for transporting goods, a proposal from Russian diplomats appeared on the possibility of using the Northern Sea Route as an alternative for delivering cargo between Europe and Asia. It is important to note that this route, connecting the Barents Sea and the Bering Strait, has a length of more than three thousand nautical miles (5556 kilometres) and is the shortest route between Europe and Asia. The project, which Russia is actively developing with the support of China, is already showing significant prospects. At the end of 2023, 36 million tons of cargo were transported along the Northern Sea Route; in 2024 this figure is planned to increase to 80 million tons. In this case, inviting global companies to use the new logistics route seems logical. Moreover, there is a high probability that China may support this initiative. However, this path will also not be loyal to all states and companies, which poses a severe challenge to the United States and its allies.

Fourth, events in the Middle East seriously impact world oil prices. Following the launch of Operation Prosperity Guardian and the refusal of several major companies to use the Suez Canal for ship passage, Brent crude futures rose 70 cents, or 0.9%, to $80.09 a barrel, and U.S. oil futures West Texas Intermediate rose 66 cents, or 0.9%, to $74.55 a barrel. Both contracts have been growing over the past two months, and each has shown an increase of more than 4% by the end of 2023. Similar trends continued in 2024.

Already in early January, both types of oil rose in price by more than 3% amid news of a terrorist attack in Iran, which killed more than 80 people. Moreover, the rise in oil prices is also affected by the situation in Libya, where oil production at the country’s largest oil field, Al-Sharara, has been stopped due to protests.

Of course, such a situation in the oil markets has broad consequences for several geopolitical processes. In particular, this situation seriously impacts the West’s ability to apply sanctions pressure on Russia, limiting its trade in energy resources. Moreover, rising oil prices will seriously affect domestic political processes in the United States, which is highly undesirable to Democrats on the eve of the presidential elections. Back at the end of October 2023, Bank of America analysts said there were possible scenarios in which the price of Brent oil would reach $150 per barrel – or even $250 due to increased geopolitical tensions. Bank of America believes a possible escalation of geopolitical tensions involving Iran will increase oil prices to $120-130 per barrel. If supplies are physically disrupted due to attacks on energy infrastructure, the oil price could rise above $130 per barrel, experts at Bank of America said. If the escalation of the conflict leads to a reduction in global supplies, for example, by 2 million barrels per day, the price of oil could exceed $150 per barrel.

Apparently, in such a situation, Angola’s withdrawal from OPEC to maintain oil production levels may be offset by events in the Middle East. At the same time, one should not count on a significant impact on the situation through the warming of relations between the United States and Venezuela, which many experts previously considered as a substantial reshuffle of forces in the geopolitical arena. In essence, the United States is faced with a serious challenge, which not only requires the creation of international coalitions but also potentially increases the risk of provoking new military conflicts.

Currently, it is difficult to predict what the escalation in the Middle East may lead to and how soon it will end. However, the interests of many states involved in trying to maintain peace (or control processes) in the region go far beyond the war between Israel and Palestine or the pirate actions of Yemen. Apparently, we are talking about a global reformatting of world logistics, which inevitably leads to new wars and attempts to lead this process.